BRS Market Report – Week III: 17 th – 20 th May 2022

- May 20, 2022

- Posted by: bartleet

- Categories: Capital Markets, Share Market

The Week at a Glance

Market round-up

The Colombo Bourse started the week on a positive note amidst renewed hopes of political stability with the appointment of the new Prime minister. However, the market experienced setbacks amidst the brewing social tensions over fuel and LPG shortages albeit ending the week on a higher note post monetary policy review.

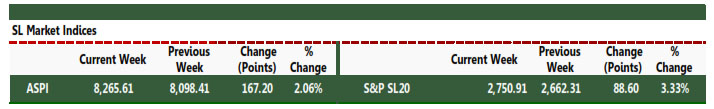

The ASPI gained 167.20 points WoW to close at 8,265.61 whilst the S&P SL 20 increased by 88.60 points WoW to close at 2,750.91.

Top gainers – MERC (+35%) emerged as the top gainer for the week followed by AAIC (+34%) and ACME (+34%).

Top losers – CALF (-24%) emerged as the top loser for the week followed by TANG (-15%) and EBCR (-15%).

Turnover for the week amounted to LKR 9.8bn averaging a daily turnover of LKR 2.5bn (4 trading days). Negotiated deals contributed to 3% of total turnover.

Top contributors to turnover – EXPO topped the turnover list with a contribution of LKR 3.6bn (~37%) while BIL followed with LKR 1.3bn (~13%). LOFC, SCAP, AAIC were traded among the top 5 during the week.

Top contributors to volume –BIL contributed ~27% while LOFC contributed ~17% to the total volume. SEMB(X), SEMB, SCAP followed suit.

Net foreign inflow/ outflow – Foreigners remained sellers on a fairly active market, posting a net foreign outflow amounting to LKR 176.4mn. Foreign sales amounted to 5% of turnover.

Foreign selling was seen on HNB, EXPO while foreign buying remained limited.

Sector gainers/losers – The Transportation sector was the top gainer for the week (+13.0%) whilst the Telecommunications sector emerged as the top loser (2.8%).

Macro Updates

Sri Lanka succumbed to an embarrassing “hard default” as the grace period for the International Sovereign Bonds (ISB) Coupon payment lapsed. However, US investment bank JPMorgan backed Sri Lanka’s crisis-hit Government bonds, saying recent political changes in the country should gradually improve its strains and help its talks with the International Monetary Fund.

The Monetary Board of the Central Bank of Sri Lanka, decided to maintain the Standing Deposit Facility Rate (SDFR) and the Standing Lending Facility Rate (SLFR) at the current levels of 13.50% and 14.50% respectively.